The Impact of Tax Reform on California Families

A study conducted by the Anderson Center for Economic Research and Hoag Center for Real Estate and Finance examines the potential impact of the Republican-sponsored House tax-overhaul bill (House bill) on the tax rates paid by California married couples filing jointly at various income levels. The study also analyzes how the House bill will affect the federal income tax rate for homeowners as compared to non-homeowners as a result of the House bill’s proposed caps on mortgage interest and property tax deductions. It is the first university-based research analysis that measures the impact of removing the deductibility of state income and sales taxes by family income level and whether a family owns or does not own a home.

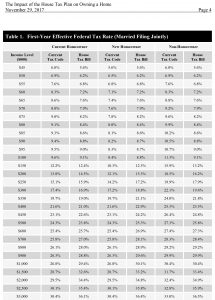

Consistent with available statewide averages, it is assumed for current homeowners that the loan-to-value is 60 percent, that 18 years remain on the existing mortgage and that the mortgage interest rate being paid is 4.3 percent. For family incomes under $100,000, the House bill will result in tax rates about one-half to one percent lower than current rates. From $100,000 to $600,000, the differences in tax rates are minimal. At income levels above $600,000, however, the loss of state and local income tax deductibility and cap on the property tax deduction under the House bill affects tax filers whose itemized deductions are greater than the standard deduction. As a result, these current homeowners will pay higher tax rates under the House bill. For example, at incomes of $3 million, the current tax rate of 30.4 percent increases to 36.1 percent.

Closer scrutiny of income levels below $600,000 reveals subtle winners and losers. At income levels under $100,000, the drop in tax rate is a direct result of the proposed increase in the standardized deduction to $24,000, which exceeds both the current standardized deduction plus personal exemptions and home-related itemized deductions. For income levels between $100,000 and $250,000, the slight increase in tax rate is attributed to the loss of deductions relating to state and local tax, personal exemptions and cap on property tax. On the opposite side of the spectrum, for income levels between $250,000 and $600,000 a slight decline in the tax rate is attributed to the benefit from the proposed elimination of the Alternative Minimum Tax, which exceeds the loss of the deductions mentioned.

For families that are not current homeowners but purchase a home after the House bill goes into effect, tax rates increase at lower income levels. The major reason for this is that the proposed caps on mortgage interest and property tax deductibility affect families at incomes starting at $100,000 with mortgage loans greater than $500,000. At incomes less than $100,000, the proposed standard deduction of $24,000 exceeds home- related itemized deductions. This effectively eliminates any tax benefit to homeownership at these low-income levels.

For those who are not homeowners, the tax rate under the House bill is about 2 percent lower than current rates for incomes below $600,000. For incomes between $600,000 and $1 million, there is little difference in rates under the current tax code or House bill. This is due to an equal tradeoff between the loss of state and local tax deductions and the gain from the proposed change in tax brackets that triggers the highest tax rate, 40 percent, at income of $1,000,001 as opposed to the current tax code’s trigger of $470,701.

Above $1,000,000, however, the House bill results in higher tax rates.

The overall findings of the Anderson Center and Hoag Center show that the tax advantages of owning a home are sharply reduced but not wholly eliminated under the House bill. This is particularly the case for families with income levels above $100,000, who count on mortgage interest and property tax deductions to maximize their itemized deductions to achieve the lowest possible effective tax rate.

The tax benefits of owning a home largely disappear for new homebuyers under the House bill. This is the direct result of increasing the standardized deduction and the new much lower caps on mortgage interest and property tax. At income levels of $100,000 and under, the tax benefit of homeownership is effectively eliminated due to the proposed increase in the standardized deduction to $24,000. The total home-related itemized deductions are less than the proposed standardized deduction, and this results in homeowners and non-homeowners paying effectively the same tax rate. For income levels over $100,000, there is a small and caped tax benefit to homeownership. The proposed lower caps on mortgage interest and property tax result in a home-related itemized deductions cap of approximately $31,000 (assuming a mortgage rate of 4.3 percent), which is reached at income levels of $150,000 and higher. In other words, the most that a family can reduce its taxable income beyond the standardized deduction because of homeownership is $7,000 ($31,000 – $24,000). The resulting tax savings are modest at all income levels and decline as gross income rises. For example, at an income level of $1,000,000 and the 40 percent tax bracket, the tax savings is $2,800 ($7,000 x 40 percent), representing 0.28 percent of gross income. At an income level of $150,000 and the 25 percent tax bracket, the tax savings is $1,750 ($7,000 x 25 percent), representing 1.2 percent of gross income. Current owners, however, incur a higher level of savings because the House bill preserves the higher cap on mortgage interest deduction for current homeowners.

Categories

Recent Posts

- ANNETTE BENING, ED ASNER, AND GARY COLE JOIN CAST CRITICALLY ACCLAIMED PLAY BRINGS THE HUMAN EXPERIENCE OF WARFARE TO LIFE

- DISNEY EXECUTIVES AND OTHER ORANGE COUNTY LEADERS JOIN CHAPMAN UNIVERSITY GOVERNING BOARDS

- Chapman University’s Office of the Provost and Musco Center Presents Provost’s Arts & Lecture Series

- General H. R. McMaster visits to commemorate partnership between Chapman University and Richard Nixon Foundation

- More Category 5 Hurricanes Forecasted by Scientists

Archives

- October 2018

- September 2018

- August 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011