Tax’s Reform’s Impact on the California State Income Tax

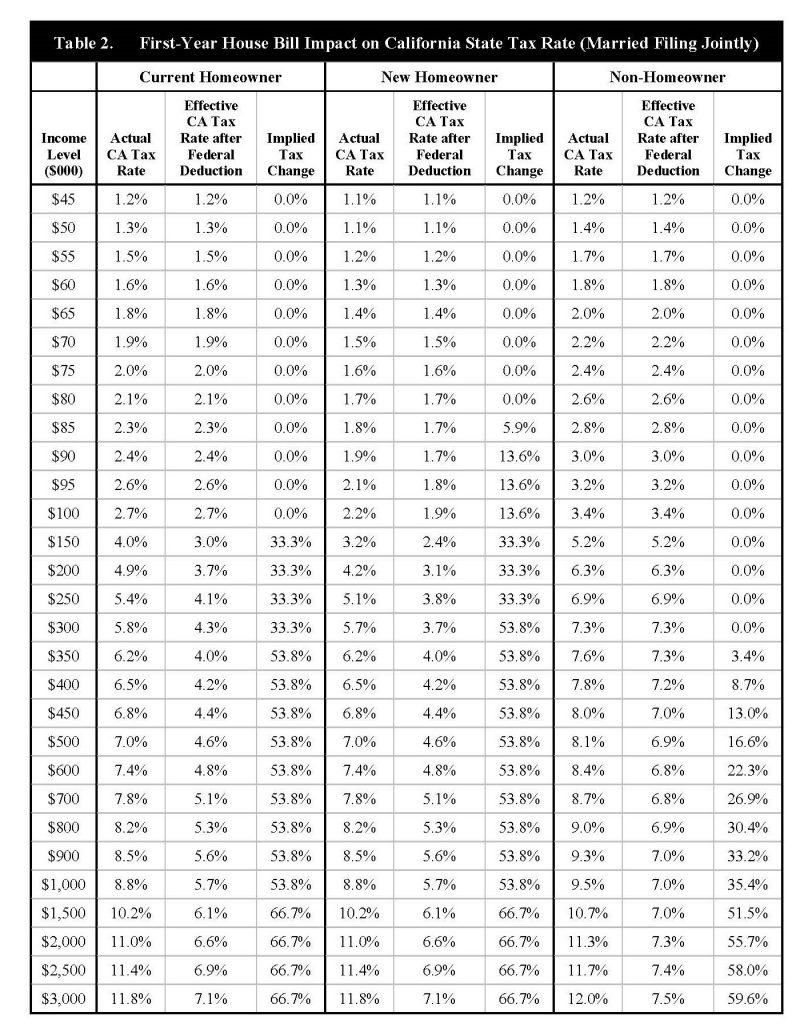

ORANGE, CA—A study conducted by the Anderson Center for Economic Research and Hoag Center for Real Estate and Finance examines the potential impact of the House and Senate tax reform bills that eliminate the deductibility of state income tax. Specifically, the Chapman University researchers determined the impact of removing the deductibility of state income tax for families with incomes ranging from $45,000 to $3,000,000. The findings suggest that the elimination of the state tax deduction for current homeowners with incomes above $150,000 is the equivalent of an increase in the effective state income tax from 33.3% to 66.7%. The 33.3% rate represents the increase for incomes of $150,000 from the current effective rate of 3% to 4% if the deductibility on federal returns is removed. The 66.7% rate represents the increase for incomes of $1,500,000 from the current effective tax rate 6.1% to 10.2% if the deductibility on federal returns is removed.

Although the study includes the impact on new homebuyers and renters (see Table 2), the following findings relate to the impact on existing homeowners.

| Table 1. The Impact on Current Homeowners of Ending the Deductibility of the California State Income Tax

|

|

| Income | Increase in the Effective California Income Tax Rate |

| $45,000 to $100,000 | No impact |

| $150,000 | 3.0% to 4.0% –> Increase of 33.3% |

| $350,000 | 4.0% to 6.2% –> Increase of 53.8% |

| $1,500,000 | 6.1% to 10.2% –> Increase of 66.7% |

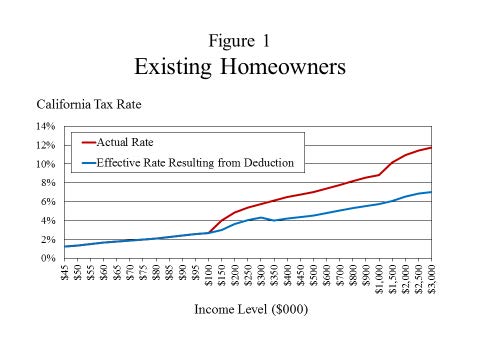

These findings are shown in Figure 1. The “Actual Rate” line shows the statutory rate while the “Effective Rate Resulting from Deduction” line shows the rate after benefiting from deducting state taxes on federal taxes. For example, at an income of $350,000, the California average tax rate is 6.2% but is effectively 4.0% after the benefit of the federal deduction. The increase from 4.0% to 6.2%, as noted in Table 1, represents an increase of 53.8% in the state income tax because of the elimination of the state tax deduction.

Figure 1 shows the impact of removing the deductibility of state income taxes across various income levels. California families with incomes above $100,000 would pay higher average state income tax rates as shown above in the “Actual Rate” line in contrast to the lower “Effective Rate” line they are currently paying. As family incomes rise, the impact of removing the state income tax deduction on federal taxes also rises.

Categories

Recent Posts

- ANNETTE BENING, ED ASNER, AND GARY COLE JOIN CAST CRITICALLY ACCLAIMED PLAY BRINGS THE HUMAN EXPERIENCE OF WARFARE TO LIFE

- DISNEY EXECUTIVES AND OTHER ORANGE COUNTY LEADERS JOIN CHAPMAN UNIVERSITY GOVERNING BOARDS

- Chapman University’s Office of the Provost and Musco Center Presents Provost’s Arts & Lecture Series

- General H. R. McMaster visits to commemorate partnership between Chapman University and Richard Nixon Foundation

- More Category 5 Hurricanes Forecasted by Scientists

Archives

- October 2018

- September 2018

- August 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011