The Digital Revolution: How APIs Transformed Apple, Google, and Amazon into the Titans of Today Faculty in Focus: Dr. Seth Benzell & Dr. Jonathan Hersh

March 8, 2024

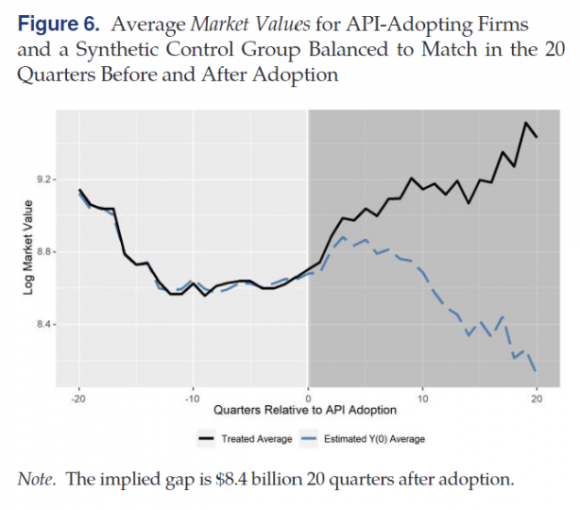

Digital platform businesses, like Apple, Google and Amazon, have become the most valuable companies on the planet. To understand why, we conducted research on a technology that has made this business technology possible: Application Programming Interfaces, or APIs. Our research shows that the adopters of public APIs grew 38% relative to non-adopters over a period of sixteen years.

The figure below shows Market Values for firms that adopted the technology, and a comparable group that did not, twenty quarters prior to tech adoption and twenty quarters after. The non-adopters lost ground in market value, to the tune of $8.4 billion. What did the adopters do that drove such extraordinary gains?

The answer is that they used an old technology — APIs, a technology that allows users to more seamlessly share data with complementary apps and consumers — in a new way to build radical business models. They “inverted” the firm.

The business model is the digital platform. Unlike a traditional ‘pipeline’ business, which buys inputs, adds value, and sells them at a higher price, a digital platform enables third parties to create value. This business model has strong supply side and demand side economies of scale, and has come to dominate the economy. By 2020, seven of the top ten US firms by market value were platforms, and hundreds of successful medium sized firms had platform models as well.

How does this work? There is a close analogy between cities and digital platforms. In a well functioning city, administrators set up infrastructure like ports and roads, and invite citizens to build on top of it. The most successful cities tend to be at the intersection of these roads.

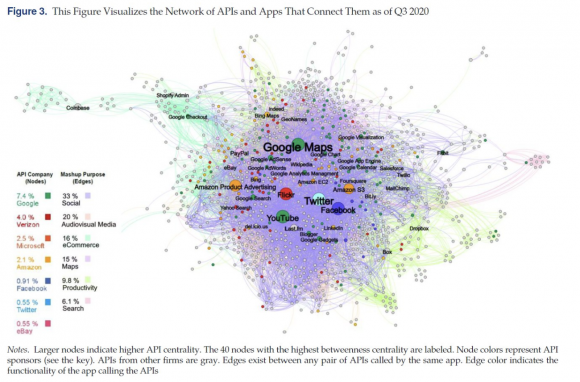

The figure below makes this metaphor more literal. It is our “map of the internet” based on data we collected on the Internet’s public APIs. In the figure, nodes correspond to APIs, which are colored by the companies which own them. Lines connecting these ports correspond to ‘mashups’ – that is, apps for your phone or computer that call these APIs. A simple example might be a social media app that draws from Google Maps to calculate a route between you and a loved one, and posts to Facebook for them to see it. You can think of these lines as ‘trade routes’ between the various ports.

Not only do we find that companies setting up API ports of call do better, we show that having an API which is more central to the network of data flows is even better for your company. We exploit the natural experiments that occur when certain APIs were shut down or modified due to a hack or companies’ strategic decision. When this occurs it changes the network of information flows — benefiting some companies and hurting others. Companies with APIs whose centrality to information flows were most harmed due to the disruption saw worse economic performance.

If APIs are so great in incentivising outside innovators to make apps and other products that complement the firms’ core offerings, why don’t all firms use them? Our research addresses this question as well. First, not all companies have a core service which is amenable to being made public via APIs. Companies in the world of atoms dealing with brick-and-mortar have no digital assets to share, and small companies might not have the scale necessary for making a whole “port” efficient. We also find suggestive evidence that API using companies are more vulnerable to data hacks — and that’s a big problem if your core service involves something essential and sensitive like plane autopilots or pacemaker monitoring.